According to the research of the American edition, CNBC in 2019 pyramid schemes hit their highest level in a decade. In 2019 State and federal authorities uncovered 60 alleged Ponzi schemes with a total of $3.25 billion in “investor” funds.

Despite the bitter experience in the 2000s, pyramid schemes became more popular in Eastern Europe as well. During the last several years these schemes “earned” more than $1 billion in Ukraine.

Let’s look at the biggest fraud cases and scrutinize how they work.

What a pyramid scheme is and how it was invented.

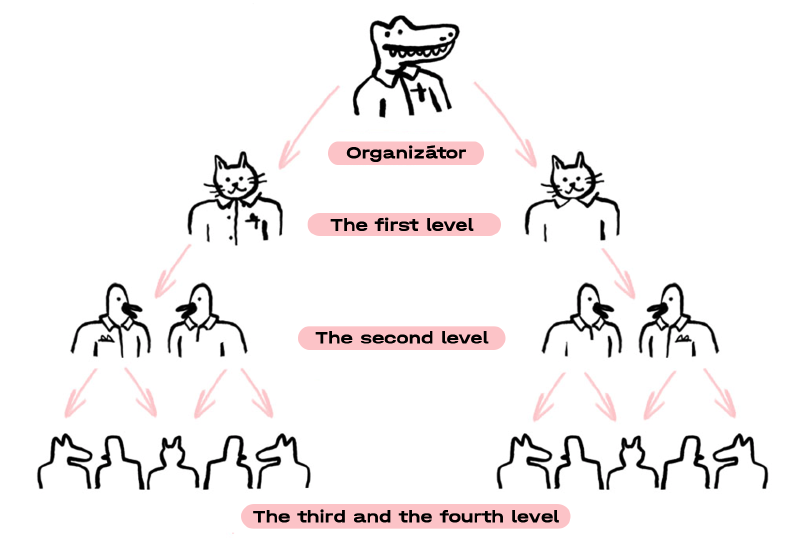

A pyramid scheme is a fraud business model. The first participants gain revenues at the expense of those who joined the pyramid later, and not through product/service sales.

The thing is, it is impossible to pay out revenues to all the participants, and the pyramid scheme creators know that beforehand. This scheme works as long as new investors guarantee the influx of funds. When new participants cease investing, the older participants cannot get their revenues, and a pyramid scheme сollapses.

This scheme is named after its structure – a large number of "investors" at the lower level provide income to fewer participants on a higher step.

At the heart of the financial pyramid lies the Ponzi scheme. This fraudulent business model was invented by an Italian emigrant, Charles Ponzi, back in 1919. He came to the United States with $ 2.5 in his pocket, and could not make money legally. Thus, the swindler Ponzi came up with a cunning scheme of easy but risky earnings.

Charles founded The Securities Exchange сompany, selling debt warrants: the "investor" invested $ 1,000, and in 90 days the company promised to pay $ 1.5,000. Fifty percent commission in 3 months — where could it come from? It turned out that Ponzi did not make any agreements. "Profit" was virtually new pyramid members’ money.

The pyramid collapsed as early as 1920, but Charles was the first to make $ 20 million this way. However, his followers earned tenfold more.

Although the terms "financial pyramid" and "Ponzi scheme" are considered synonymous, they have some differences:

- life expectancy: classic pyramids expire faster. They focus only on the constant influx of new investors, while Ponzi schemes try to keep the old ones as well.

- legal status: Ponzi schemes are outright fraud, and pyramids can sometimes be a part of a legitimate business.

- work structure: pyramids require "investors" to constantly bring new people. Before sending the money "upstairs", the participant receives a commission. In Ponzi schemes, the received funds are immediately used to cover the income of the previous depositors.

The main features of financial fraud schemes

Here are 5 common features that will help to identify a Ponzi scheme or a pyramid in an investment fund:

- high return guarantee with minimal or no risk (impossible)

- the market situation does not affect profitability (impossible)

- lack of data on the source of income (unlikely)

- the fund does not disclose details of the investment strategy (probably the investment strategy simply does not exist)

The Biggest Pyramid Schemes in Modern History

#1. Madoff Investment Securities

Investors' losses: $ 65 billion

The largest financial pyramid of all time, disguised as an investment fund. Its creator, Bernard Madoff, is one of the founders of the NASDAQ stock exchange and a well-known philanthropist.

In 1960, he founded Madoff Investment Securities — a company engaged in the purchase and sale of securities on the stock exchange, that was considered one of the most reliable investment funds on Wall Street.

Madoff had an excellent reputation: he donated millions of dollars to charity, his company was among the top 25 largest in the stock market, and consistently brought investors a huge annual revenue of 12%. Among the investors of Madoff Investment Securities were major global banks and celebrities. All of them believed that his fund could pay such an interest because Madoff had insider information.

However, 40 years later it occurred that the businessman paid old investors from the funds brought by new clients. That is, he acted following the classical Ponzi scheme. Madoff's sons became aware of this fact and handed him over to the authorities.

As a result of the biggest financial scam, 3 million people suffered losses and at least 4 people died. Several bankers and a son of Bernard’s, the one who gave out his father, committed suicide.

Madoff was sentenced to 150 years in prison for fraud. He has been remaining in prison since 2009.

#2. МММ

Investors' losses:> $ 2 billion

MMM is the largest financial pyramid in Eastern Europe, due to which people of the region have long forgotten about investments as passive income. Its collapse was a disaster for millions.

In 1989, a Moscow-resident, Sergei Mavrodi, together with his brother and wife founded the MMM company. A small firm sold office equipment throughout the Soviet Union. The business was successful, and by the early 90's MMM became a market leader.

However, after scaling up, the company had problems with the law. State financial control accused MMM of tax evasion. It became difficult to run the business, and Mavrodi decided to switch to the financial sector.

At first, MMM tried to sell American shares, but it did not work as investors did not trust them. Then Mavrodi decided to issue his own shares with a face value of 1 thousand rubles. It was in 1994. That was how the history of MMM as a financial pyramid began.

The company's securities without any reason rose in value day by day. Loud advertising and bright slogans "today it’s more expensive than yesterday" did their job. Thus, the television spread the first report: MMM paid its shareholders 1000% of yearly dividends. The number of depositors has risen sharply.

Сuriously, but the value of MMM shares was set by Mavrodi himself. Twice a week he personally announced new purchase and sale prices.

In just six months, the value of MMM securities increased 127 times. In the same year, 1994, the company promised to pay 3000% dividends to shareholders. As MMM was a classic pyramid, high-interest rates on old deposits were ensured only via attracting new ones.

There was enough money to pay investors up to July 27, 1994. After that, Mavrodi reduced the company's shares value by 127 times – down to 1 thousand rubles, as at the time of their first issue. The pyramid collapsed.

Immediately after this news, 50 people committed suicide. MMM's office and Mavrodi's apartment were stormed by the Special Police Force, and the founder of the pyramid was arrested for tax evasion. According to him, about 15 million people sustained damage from MMM.

#3. Stanford International Bank

Investors' losses: $8 billion

Robert Allen Stanford founded a huge financial pyramid disguised as a bank.

In 1983, Allen Stanford started the real estate trade in Florida, but he did not manage to succeed legally. Finally, the businessman decided to move his business to Antigua and Barbuda, which is offshore in the Caribbean. This insular power could help him to hide from American fiscals and run his "business" in peace. In 1986, Stanford opened Stanford International Bank there.

The Bank issued deposit certificates, which is an alternative to the deposit. Stanford International Bank’s conditions were much more attractive than overall market conditions. For example, such certificates’ returns were consistently higher than in other banks. Suspicious customers were persuaded that the certificates were fully backed by Stanford International assets.

In addition, Allen forged the bank's documentation so that no one would know the real state of affairs. And the truth was this: high-interest payments were only possible thanks to the arrival of new depositors and their money. A classic pyramid.

The Bank had been operating for 23 years, during which time its founder had embezzled about $8 billion from depositors. Stanford International Bank raised money not only in the United States but also in the Caribbean and South America.

US authorities unmasked Stanford only in 2009 as the location of the company had been long playing into his hands. In 2012, the billionaire was imprisoned for 110 years for creating a fraudulent scheme.

#4. European Kings Club

Investors' losses: $1,1 billion

This big European financial pyramid operated in Switzerland, Germany, and Austria from 1992 to 1994. It included about 94 thousand people. Every tenth suffered damages from the Club in some Switzerland cantons.

The European Kings Club was to become a place for the selected small and medium-sized businesses, where they could be provided with financial support. However, to join the Club you had to buy a "letter" – in fact, a share of the Club, for 1,400 German marks ($ 2324 today). At the same time, depositors were promised to be paid 200 marks a month. This is a very high return for an organization only selling shares.

The pyramid continued to operate until the authorities of Germany and Switzerland arrested the founder of the Club, Damara Bertges, and her colleague for fraud. This caused mass unrest in Switzerland, Austria, and Germany, as depositors refused to admit that they had been deceived. They even demanded the release of swindlers, because at the time of denunciation the pyramid was still working.

As a result, during the rummage in the Club, the fiscal authorities found 500 million marks ($ 830 million) and returned them to investors. However, the amount of the shares sold equaled 1.6 billion francs ($ 1.8 billion).

Despite the scale of the scam, the organizers of the scheme were imprisoned for only 5 years.

#5. Caritas

Investors' losses: $1 billion

Caritas was a financial pyramid in which half of Romania's population took part. During the year of its existence, swindler Ioan Stoica deceived 4 million people. However, he had his state’s assistance

In 1992, Ioann Stoica opened Caritas to financially "help" the Romanian people during the hard times of the 1990s. The name of the scheme was carefully thought out: "caritas" means "mercy" in Latin. This seemed similar to the name of international charitable organizations, which aroused trust. And Romanians believed.

Caritas promised a crazy interest rate: 800% in 3 months. The deposits themselves were initially limited to $ 50, then the minimum amount increased up to $ 100 and the maximum up to $ 800. It was big money for the Romanian population, but Caritas has become very popular with people – every second one has invested in a scam.

Television and politics have played a huge role in this spread of Caritas. The organization was patronized by a member of the Romanian Nationalist Party, Gheorghe Funar. He was also the mayor of Cluj and even leased part of the city administration to Caritas. Funari paid the local newspaper out of his pocket for publishing a list of the “fortunate souls" who multiplied their investments 8 times. A month later, the pyramid fell.

Nevertheless, all this time the government was aware of the illegal activities of Caritas, even the president did not dare to intervene. The government feared street protests and angry investors’ reaction.

Before bankruptcy, Caritas raised about $ 3 billion, and on the "most successful" days, the organization had one-third of all Romanian banknotes at its disposal. The organizer of the pyramid spent 1.5 years in prison. As for Gheorghe Funar, he is still in politics – in 2014 he ran for president of Romania but lost the election.

#6. Mutual Benefits Corporation

Investors' losses: $1,25 billion

This pyramid was organized by an experienced swindler Joel Steinger. His organization was notable for earning on death.

In 1994, Steinger founded the Mutual Benefits Corporation, although he was only listed as a consultant. At that time, the US Securities and Exchange Commission had already banned Joel from selling securities. But that didn't stop him.

Mutual Benefits Corporation made money on viatical settlements - shares on life insurance policies for terminally ill people. The point was that the patient was selling his insurance to other people, knowing that he was unlikely to need it. It was beneficial to the sellers: they received from the buyers a one-time income within their lifetime, not a posthumous payment from insurance.

The buyer of the viatical also benefited from this: he became the new owner of the policy, paid monthly contributions, and received payments for it in the event of the death of the previously insured.

Mutual Benefits Corporation bought their policies from patients, resold them to third parties, and became an intermediary between the insurance company and the new shareholders. The latter made monthly contributions, and Mutual Benefits promised them a good percentage of the posthumous insurance payment instead. If of course, the first policyholder did die.

But this scheme was deliberately complicated to confuse potential investors. All it took from depositors was to bring their money to Mutual Benefits Corporation. The company's employees then provided investors with false reports of "deadly" diseases of policyholders. Allegedly, very soon they should receive their percentage of the posthumous insurance payment. But no one died en masse, so fraudsters had to pay interest to old depositors with the money brought by new participants. And this is a classic Ponzi scheme.

In 2001, Joel Steinger was handed over to the police by the doctor who falsified patients' diagnoses for Mutual Benefits. In 2014, the swindler was imprisoned for 20 years.

The company operated until 2004, having sold 30,000 life insurance policies for $ 1.25 billion.

Movies/books about pyramid schemes

#1. «The Wizard of Lies» (2017)

A film about Bernard Madoff who had been managing to deceive fellow bankers and hundreds of thousands of private investors for 40 years. The plot is based on real events, the so-called "Bernard Madoff affair", the largest pyramid scheme in history. Starring Robert De Niro. The slogan of the film: "Only those you trust can truly betray you."

#2. Coleen Cross «Anatomy of a Ponzi Scheme: Scams Past and Present: True Crime Tales of White Collar Crime»

The book features a complete picture of the Ponzi scheme - the history of its creator, the principles of work, and the most scandalous cases. In addition, Cross writes how to recognize this fraudulent scheme to make the reader more careful.

#3. «Betting on Zero» (2016)

A documentary by Ted Brown. This is a mini-investigation of the activities of the American company Herbalife, specializing in healthy eating. In the film, the director provides evidence and facts that the transnational Herbalife company is a financial pyramid that will soon collapse.